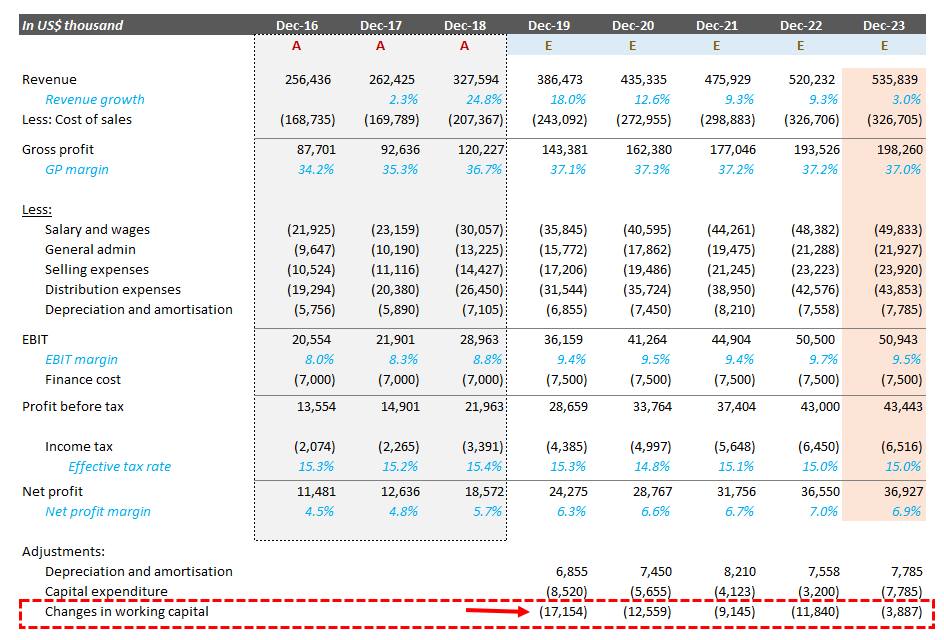

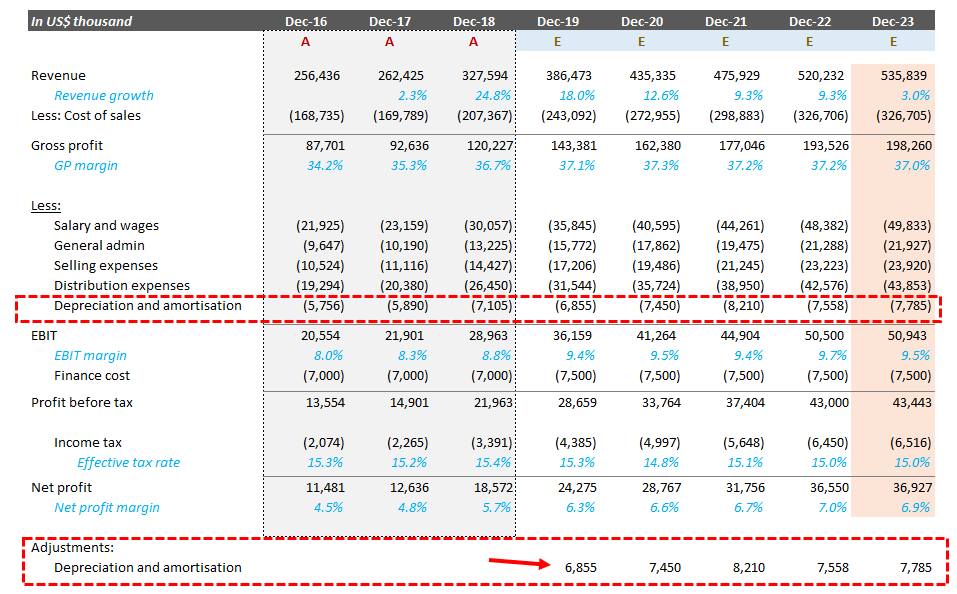

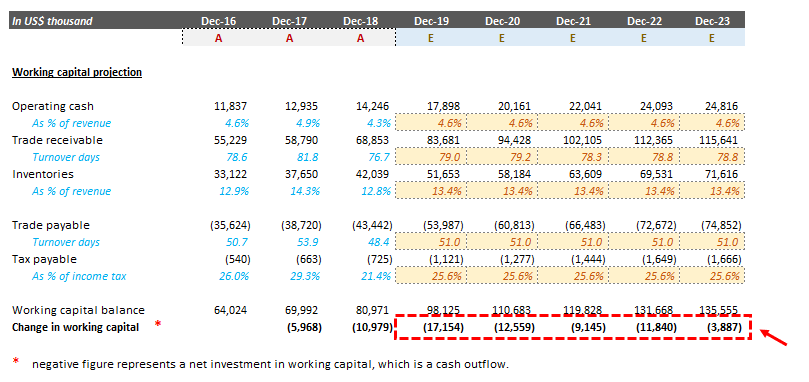

change in net working capital dcf

In other words DCF valuation model uses the. As of October 3 2017 the company had 218 million in current assets and 384 million in current liabilities for a negative working capital balance of -166 million.

Change In Working Capital Video Tutorial W Excel Download

Denotes the final or additional years.

. However if the change in NWC is negative the business model of the company might require spending cash before it can sell. Sales Formula Example 1. Current ratio and the quick ratio.

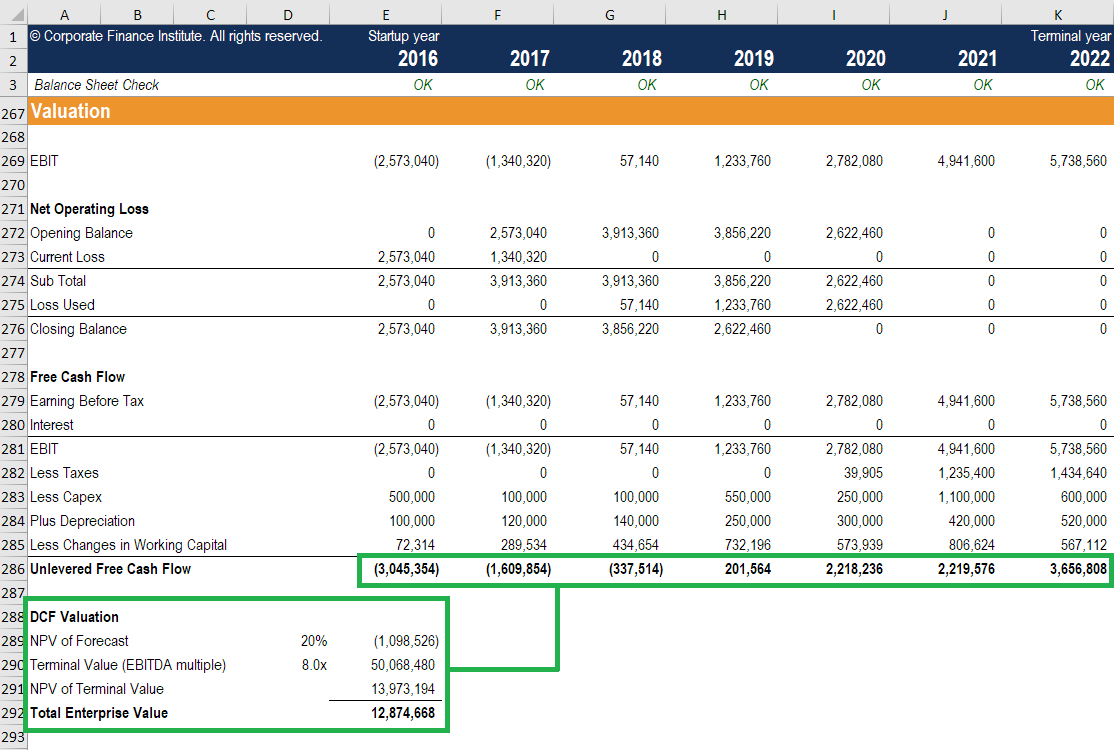

Discounted cash flow DCF is a valuation method used to estimate the value of an investment based on its expected future cash flows. WACC includes the average cost of a firms working capital minus taxes. As a working capital example heres the balance sheet of Noodles Company a fast-casual restaurant chain.

If the change in NWC is positive the company collects and holds onto cash earlier. This DCF analysis assesses the present fair value of assets or projectscompanies by addressing factors like inflation risk cost of capital analyzing the companys future performance. DCF method can be used for projecting long-term valuation which can extend up to a decade or even more.

Example Lets assume that Mr. Discounted cash flow DCF valuation model determines the companys present value by adjusting future cash flows to the time value of money. Out of the total 3 million toys were sold at an average selling price of 30 per unit another 4 million toys were sold at an average selling price of 50 per unit and the remaining 3 million toys were sold at an average selling price of 80 per unit.

The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. DCF analysis attempts to figure out the value of an investment. In the case of a bond the discount rate is the rate of interest.

Let us take the example of a toy-making company that sold 10 million toys during the year. Shankar plans to make an investment of Rs1 Lakh in.

Change In Working Capital Video Tutorial W Excel Download

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Change In Net Working Capital Nwc Formula Calculator

Change In Net Working Capital Nwc Formula Calculator

Discounted Cash Flow Analysis Veristrat Llc What S Your Valuation

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Dcf Model Training The Ultimate Free Guide To Dcf Models

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy